How Much Cash Should You Have on Reserve?

Brad Baker

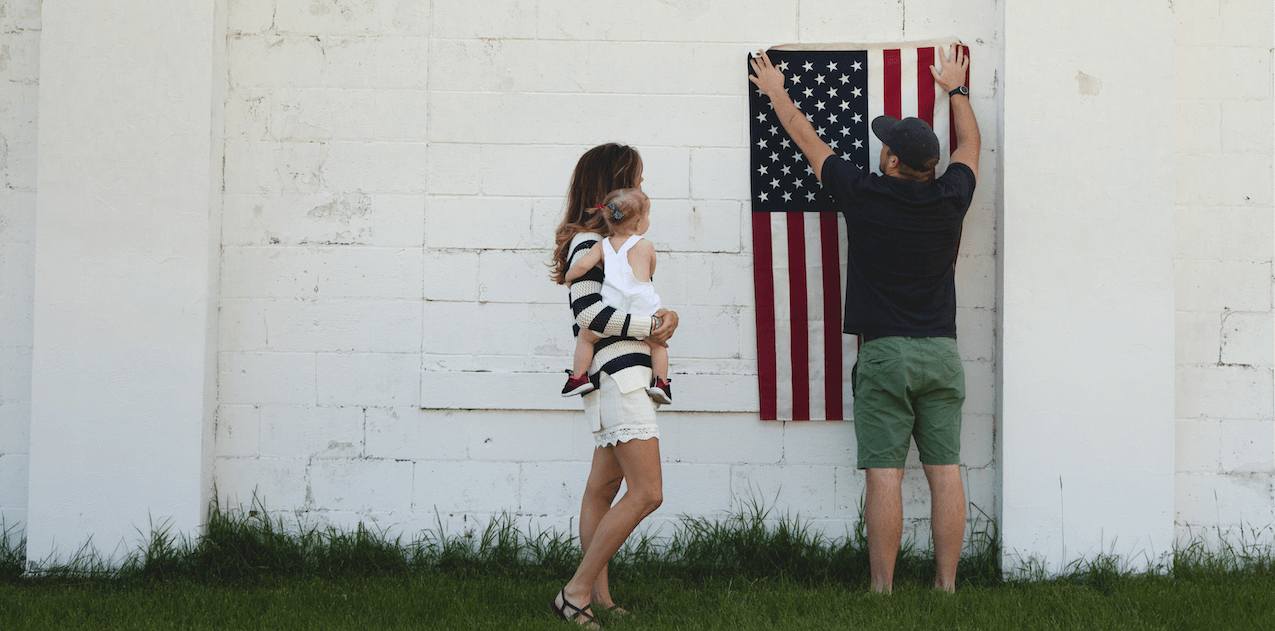

This is an important question everyone should ask themselves. Many finance experts suggest that you should have at a minimum of 3-6 months of monthly bills saved up in case you happen to find yourself out of work. However, being in the military most of us will not lose our job very quickly so this may not relate to most of us.

A few things to consider would be what types of emergencies are likely to occur that would affect you financially.

Spouse’s Income:

If your spouse currently holds a job and you rely on his or her income on a monthly basis then in the event your spouse becomes laid off it would be a good idea to have 3-6 months worth of your spouse’s pay saved up. This financial cushion can help cover essential expenses like rent, utilities, and groceries while your spouse searches for a new job. One way to accelerate your savings goal is by taking advantage of lucrative opportunities, such as bank bonuses worth $11,425, which can significantly boost your emergency fund. Being proactive about savings ensures greater financial security and peace of mind during uncertain times.

PCS:

I have seen so many times people who receive PCS orders that do not have a dime saved up. Yes, the army will reimburse you for moving but sometimes you may not get that money until its too late. Having a good amount of money to pay for shipping, gas, food and a place to stay is a good idea. I personally do not like to rely on others and would like to know that I am prepared to take care of my family just in case paperwork gets messed up and payment gets delayed.

Emergency Leave:

Being in the military means living far from home and family members. When there is a family emergency will you have the funds available to fly home on short notice and pay for food and hotel? Sure the Army Emergency Relief fund is available but can be a hassle filling out the paperwork and talking to the commander and waiting for the funds. If you set aside money ahead of time then that will be one less thing to worry about in a time of grief.

Vehicle Breaks Down:

I’m not necessarily talking about a flat tire but rather something drastic that would require thousands of dollars worth of repairs or even buying a new vehicle. Sometimes things just happen and you need to be prepared for the worst. You may have to rent a vehicle for a week or so and pay for costly repairs. Having a few thousand on hand can help you avoid borrowing money at a high-interest rate.

These are just a few examples but if you have adequate insurance plans and save approximately 3-6 months worth of pay and set it aside somewhere safe and somewhere liquid (meaning easily accessible as opposed to having to sell a home in order to acquire the money) then you should be just fine for most scenarios. Just ask yourself what if your monthly income suddenly stops coming in or has to be redirected to something much more urgent? How long can you survive on your own in this situation? Below is a picture of the USAA app. As you can see if you have an emergency and need to take out a loan it could cost you $747.10 in interest for a $5000 loan at 7% for a 4-year term.