Set up Automatic Savings and Pay Yourself First

Brad Baker

This has to be one of the greatest things I ever did for myself. When I first joined the military I would sit down multiple times a week and write down all my earnings and all my bills and look at what was left. This number was usually pretty big and I would get excited. I then began to think about how quickly I could save up for a new car or a new TV. However, at the end of each month, I would not have any savings left. I could not figure out where it was all going.

The problem was that I was not figuring in little things that add up quickly such as buying energy drinks at the gas station and grabbing a magazine while I was there or having to spend $14 on a new light bulb for my truck. After months and months of trying new ways to save this money without “accidentally” spending it, I finally figured it out. I will pay myself first through automatic savings.

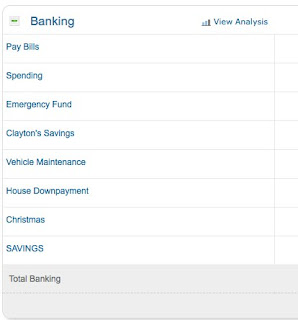

USAA is a great bank and it allows me the convenience of setting up multiple accounts and creating nicknames for each account free of charge. With this, I am able to create accounts for things like vehicle maintenance, Christmas fund, vacationing, emergency fund and even a separate account for my son. With a few seconds, I can set up money to be automatically moved to each account at the beginning of each pay cycle.

Here is how I set mine up:

First I decided on what I will save. I decided to separate my money as follows:

- $65 a month for vehicle maintenance

- $35 a month for Christmas

- $50 a month for my son

- $50 a month for general spending savings.

- $125 for a Roth IRA account

- $650 in combined bills (not counting groceries)

- The rest for general spending including groceries

I then added up 1-6 to come up with a total of $975 and rounded to $1000 to be safe. I then set up a special checking account and named it “Bill Pay” and also a checking account and named it “Spending”

My bi-weekly direct deposit paycheck goes into the “spending” account but first I have set up an allotment through MyPay of $1000 going into my “bill pay” account. This allows for the full $1000 to be deposited into my bank at the first of every month so I do not have to worry about the due dates for the bill being spread out over the month. But my general spending is still deposited bi-weekly so I do not overspend at the beginning of the month leaving nothing for the end of the month.

Now that the $1000 is deposited on the first to my “bill pay” account I have created multiple savings accounts and nicknamed as follows

- Vehicle Maintenance

- Christmas

- Son’s Savings

- Savings

I then set up automatic reoccurring transfers for each savings account that is transferred from “bill pay” on the 2nd to ensure the money has gone through. I also have set up a Roth IRA account and implemented automatic reoccurring investing into a mutual fund of $125.

Lastly, I have set up automatic bill pay for my bills each month. I also use a specific credit card only for gas and have set up automatic bill pay to pay the credit card off in full each month as well.

The end result is everything is automated and I am left with just enough for groceries and regular unnecessary spending money for things such as going out to eat and shopping. I only have to worry about having enough for my weekly groceries, everything else is taken care of and at the end of the month my savings has grown and bill are paid. I am in the processes of setting up another credit card for groceries and will eventually do the same as I do with gas. This system has given me peace of mind and allowed me to focus on other aspects of my life without constantly stressing about money management. I’m also starting to explore emergency financial support options, just in case unexpected expenses arise and I need a safety net. Having these measures in place ensures that I’m prepared for whatever comes my way, while still staying on track with my financial goals.